The world's seafood leader Thai Union Group announced the closure of a USD 327 (THB 11.5 billion / EUR 300 million) loan that marks the start of the second phase of its Blue Finance agenda. Both the key performance indicators (KPIs) and the sustainability performance targets (SPTs) of the loan are aligned with the company's sustainability ambitions set out in its SeaChange® 2030 plan, which the company presented in July.

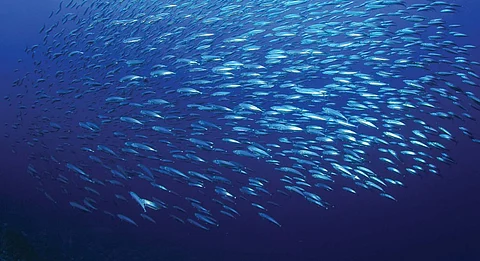

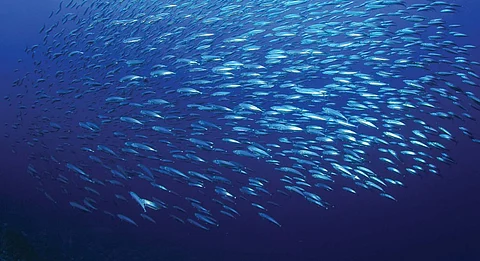

Financing with sustainability objectives to benefit de oceans, this is what Thai Union's Blue Finance is all about, and, between 2020 and 2022, the company already managed to successfully complete its first phase by increasing its long-term sustainability-linked financing to 50 percent.

The sustainability-linked loan (SLL) worth USD 327 million announced now marks the beginning of the second phase of its Blue Finance agenda. This time, the seafood giant goes one step further and sets itself a new target: to increase sustainability-linked finance to 75 percent of its long-term financing by 2025.

Denominated in both U.S. dollars (USD) and Thai baht (THB) across tenors of three and five years, Thai Union said the successful closing of this dual-tranche facility represents another major step forward for the company and its commitment to this Blue Finance agenda. Indeed, its demonstrated commitment to sustainability is what has enabled it to access this sustainable financing, which includes a reduction in interest rates when committed targets are met.

"Thai Union is pleased to receive strong support from their leading relationship banks," said Thiraphong Chansiri, CEO of Thai Union, commenting on securing the loan. "At Thai Union, sustainability resides at the very core of our business. Since the introduction of SeaChange® in 2016, we've seamlessly woven this sustainability strategy into our entire global operations."

"SeaChange® played a pivotal role in instigating the launch of the first phase of our blue financing program three years ago," he continued. "Now, with SeaChange® 2030, we've set more ambitious goals encompassing both people and the planet. Our 2030 objectives serve as key performance indicators for the new SLL, underscoring our steadfast commitment to sustainability. This unequivocally demonstrates how our dedication will fortify Thai Union's position as a leader in the capital market."

As mentioned above, both KPIs and SPTs focus on the company's overall ESG performance, including maintaining consistently high rankings in the Dow Jones Sustainability Indices (DJSI) Food Products Industry Index - last year it ranked No. 1. Importantly, the framework also includes the expansion of Thai Union's success in sustainable fisheries to responsible aquaculture through certifications and Aquaculture Improvement Projects (AIP) to set the new standards and practices for the aquaculture industry on a global scale.

The provider of the Second Party Opinion Report on KPIs and SPTs, DNV, confirmed the alignment to the Sustainability Linked Loan Principles. Each KPI and SPT progress will be verified by external organizations to ensure a fair and independent assessment.

HSBC, Bank of Ayudhya PCL, MUFG Bank, Ltd, Mizuho Bank, and Sumitomo Mitsui Banking Corporation are the group of leading banks that have jointly underpinned the new financing, acting as Mandated Lead Arranger and Bookrunner (MLAB) and sustainability coordinators. All of them have expressed their satisfaction with their participation in Thai Union's Blue Finance.

"This transaction reflects Thai Union’s commitment towards a sustainable seafood industry. Being the first global seafood company to set goals is a clear testament to Thai Union’s ambition as a sustainability leader," said, for example, Giorgio Gamba, CEO of HSBC Thailand. "Sustainability is not just a goal, but a fundamental foundation for success," remarked Kenichi Yamato, President and CEO of Bank of Ayudhya PCL.

"We are very pleased to learn that Thai Union is committing itself to very ambitious sustainability goals which require beyond business-as-usual efforts and resources to monitor the entire supply chain and is an exemplary role model for other companies in Thailand and industry peers globally," stated Kei Shirota, Country Head of Thailand, General Manager of Mizuho Bank.

"Thai Union's adoption of rigorous and pioneering Key Performance Indicators (KPIs) sets a commendable standard for the entire industry and it signifies the harmonious alignment of Thai Union's moral commitment to Environmental, Social, and Governance (ESG) principles and SMBC's capability to provide innovative financial solutions tailored to the specific needs of sustainability-driven enterprises," emphasized for his part Takashi Toyoda, Country Head of Thailand and General Manager of Bangkok Branch, Sumitomo Mitsui Banking Corporation.

Thai Union Group PCL has been bringing seafood products to customers across the world for 46 years. The company is regarded as one of the world's leading seafood producers and is one of the largest producers of shelf-stable tuna products. Its global workforce of more than 44,000 people is dedicated to pioneering sustainable and innovative seafood products.

With a commitment to 'Healthy Living, Healthy Oceans', Thai Union is a member of the United Nations Global Compact, a founding participating company of the International Seafood Sustainability Foundation (ISSF), and current Chair of Seafood Business for Ocean Stewardship (SeaBOS). The company's ongoing leadership in sustainability has been taken to the next level with the announcement of the Group’s sustainability strategy, SeaChange® 2030.